Assets Recovery and Management Agency (ARMA) is ready to take part in the implementation of the prepared recommendations of the Organization for Economic Cooperation and Development (OECD) related to the fight against tax crimes. In addition, the Agency actively cooperates with the OECD in other directions in the field of anti-corruption.

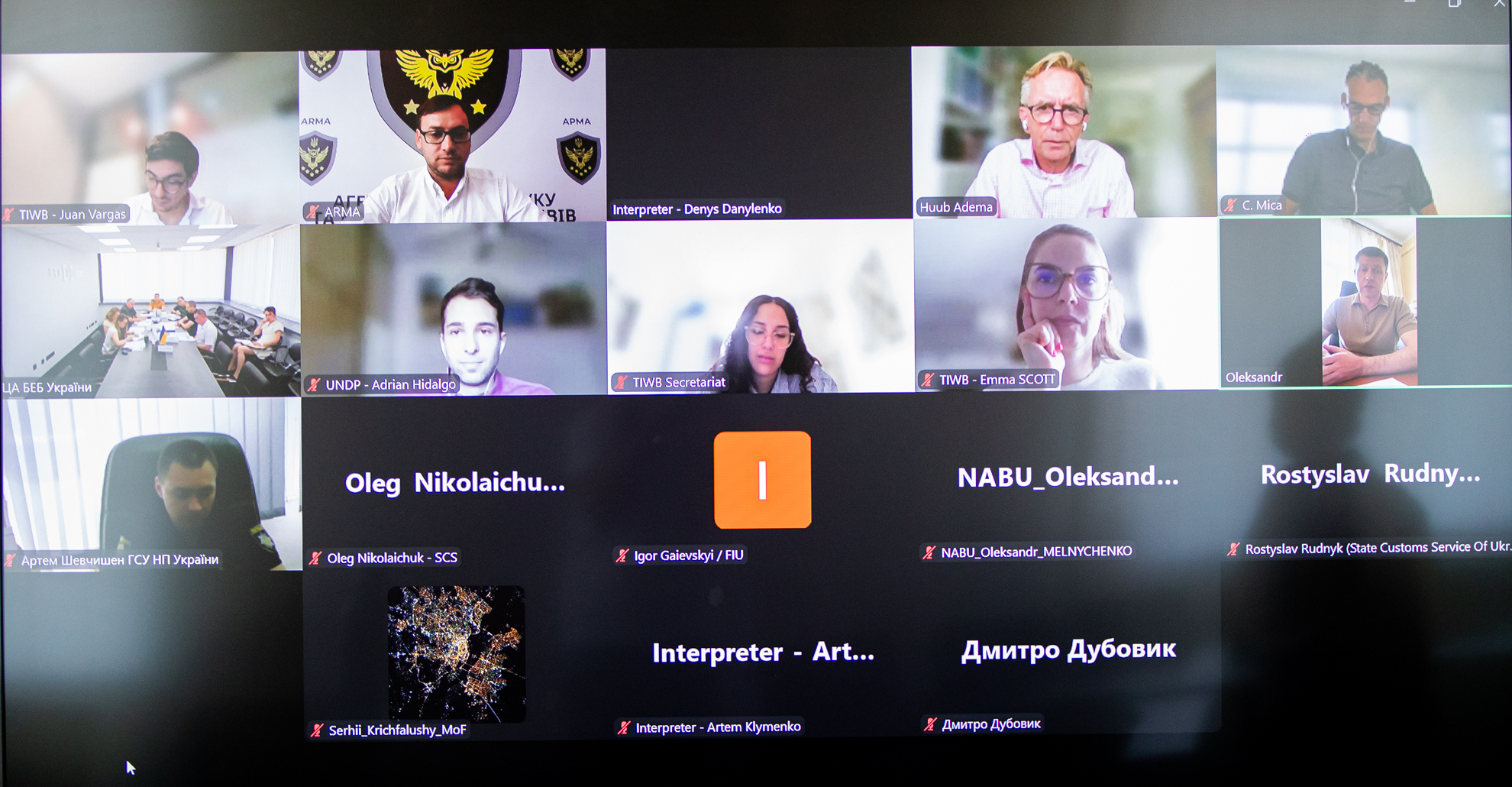

This was stated by Deputy Head of ARMA Pavlo Velikorechanin during an online event devoted to the approval of the Report on gaps in the fight against tax crimes within the framework of the Ukrainian OECD program "Tax inspectors without borders - criminal investigations" (TIWB).

"ARMA representatives took an active part in the study of the Ten Global Principles of Combating Tax Crimes and the Maturity Model of their Investigation, developed by the OECD. In cooperation with other participants, the Agency provided the necessary findings for the Report prepared by the TIWB-CI expert. ARMA is ready to implement the new prepared recommendations of the OECD in the field of combating tax crime," the Deputy Chairman of ARMA emphasized.

The event was also attended by representatives of the Economic Security Bureau, the National Anti-Corruption Bureau of Ukraine, the Prosecutor General's Office, the National Police of Ukraine, the Ministry of Finance of Ukraine, the State Financial Monitoring Service of Ukraine, the State Customs Service of Ukraine and the State Bureau of Investigation.

The key issue of the discussion is the strengthening of Ukrainian legislation in the field of combating tax crime. In particular, the introduction of the procedure for seizure and confiscation of virtual assets, including the transfer of assets between crypto wallets.

We will remind that in March of this year, ARMA specialists took part in the introductory session of the Ukrainian TIWB program, where they, together with other participants, identified gaps and formed a list of recommendations for the action plan for further combating tax crimes.